Applying for aid

There is a common myth that financial aid is just grants, money that doesn't have to be paid back. But financial aid is so much more that that! It is everything we include in your financial aid award offer such as grants, scholarships, work-study, federal student loans, and non-federal student loans.

Applying for financial aid starts with a FREE online application called the Free Application for Federal Student Aid, or FAFSA. You can complete this application at, studentaid.gov/. This application must be filled out and submitted every year.

The FAFSA opens every Oct. 1 for the upcoming fall and spring academic year.

MSU’s priority funding deadline is April 15 of every year.

If you are past the April 15 deadline, we will still process your application and award you what you are eligible. Keep in mind that some funding for work-study and University grants are limited on a first come, first serve basis. It’s important to apply early and submit any requested documents as soon as possible to maximize your eligibility every year.

All applicants for federal student aid are considered either “independent” or “dependent.” Dependent students are required to include information about their parents on the FAFSA.

A common question asked by your peers is whether they can declare themselves independent. Unless you can answer yes to one of the questions in the infographic, you are considered a dependent student and must submit your parents' information on the FAFSA – even if they do not claim you on their taxes or provide any financial support to you.

Only in rare circumstances - when there is documentation of a complete break in the family situation - can our office override the general dependency criteria. If you think your situation qualifies for a dependency override, please contact our office and consult with one of our staff members.

Provide information for the parent you lived with the most during the 12 months preceding the date you completed your FAFSA. It does not make a difference which parent claims you as a dependent for tax purposes.

If you do not live with either parent or lived equally with each parent, the parental information must be provided for the parent you received the most financial support from during the preceding 12 months or the parent you received the most support from the last time support was given.

Yes. If the legal parent you are providing information about on the FAFSA is remarried, you must include income and asset information for both your legal parent and stepparent.

Types of aid

Grants are awarded to students with financial need as determined by the FAFSA. To be considered, you must complete the FAFSA each year.

For more information regarding federal grants, visit StudentAid.ed.gov.

The Minot State General Scholarship Application for the next academic year opens in December with a deadline of Feb. 15. Not all Minot State colleges and departments use the online application so check with your college and/or department for additional scholarship information.

New freshmen students that are U.S. or Canadian citizens are eligible for the MSU Academic Excellence Scholarship. You must be admitted to Minot State by the priority deadline of February 15 for the fall semester. Awards are based on your final official unweighted high school GPA provided to the MSU Enrollment Service Office. No additional application other than the application for admission is required for this award. To be admitted to Minot State, apply at askMSU.com/apply.

To be eligible for a Transfer Student Scholar Award or Cultural Diversity Tuition Waiver award, you must complete the Minot State General Scholarship Application by the Feb. 15 deadline.

Federal work-study provides part-time employment opportunities, allowing you to earn money to fund your college education while gaining valuable work experience you can include on a future resume’.

The first step in applying for student employment is to visit the Minot State Office of Human Resources web site under, Student Employment Openings at Minot State University.

If you are unsure if you are work-study eligible, we can look up your FAFSA information and determine if you are eligible for federal work study. Federal work study eligibility is based on need as determined by your FAFSA.

Once you find an employment position that interests you or fits your skill, the next step is for you to apply for the employment positions on the Human Resources web site. If you are offered a position and you accept the offer, then you will need to fill out your new hire paperwork at the MSU payroll office, located in the MSU Administration building, 2nd Floor. For new hire paperwork, you will need:

- one form of photo ID, and

- Social Security Card or

- Certified Birth Certificate

- If you can provide a Passport, no other documentation is needed.

Federal Direct Loans are available if you complete the FAFSA and enroll in at least six credits as an undergraduate student or at least five credits as a graduate student. There are two different types of Federal Direct Loans: subsidized and unsubsidized.

You will need to accept, decline, and/or reduce the federal loans you're offered through Campus Connection under the Student Homepage. Click the Financial Aid Tile > Accept/Decline.

Subsidized loans are need-based loans. The federal government pays the interest on the loan while you are enrolled in school at least half-time and during your period of deferment. Subsidized loans are only available to undergraduate students.

Unsubsidized loans are non-need based loans. The federal government does not pay the interest while you are in school. It is your responsibility to pay accrued interest while in school or choose to capitalize the interest. Unsubsidized loans are available to undergraduate and graduate students.

More information on Federal Direct loans is available at StudentAid.ed.gov.

As a dependent student, your aggregate undergraduate Federal Direct Loan borrowing limit is $31,000, with up to $23,000 being subsidized.

If you are an independent student, your aggregate undergraduate Federal Direct Loan borrowing limit is $57,500, with up to $23,000 being subsidized.

It is possible to reach these limits prior to completing your program.

TIP: Only borrow what you need! Keep track of how much you have borrowed in federal loans at studentaid.gov.

Repayment on federal student loans begins six months after you graduate, withdraw, or drop below half-time enrollment. Repayment on PLUS loans, however, begins when your loan is fully disbursed. To reduce the overall amount that you will owe on your loans, we encourage you to make monthly interest payments before your repayment begins.

All federal student loans have a loan servicer that handles bill and other services. You can find your federal loan servicer by visiting studentaid.gov. Once you have identified your servicer, visit their website to make a loan payment or payment arrangement. For private loans, contact your lender for details on repayment.

Eligibility of aid

All eligible students qualify for some form of financial aid, regardless of income. Financial aid is offered in the form of grants, scholarships, student and parent loans, and work-study. The type of aid you are offered is dependent upon the information you report on the FAFSA and the Expected Family Contribution (EFC) calculated by the FAFSA.

Your Expected Family Contribution, or EFC, is a number determined by a federal formula that includes the information you report on your FAFSA.

Your EFC is not the amount of money your family will have to pay for college, nor is it the amount of federal student aid you will receive. It is the number used by the school to calculate how much and what type of financial aid you are eligible to receive.

Yes. Your enrollment at 11:59 p.m. on the last day to add and/or drop a regular 16-week course at 100% refund of tuition and fees, for both fall and spring semesters, will determine your enrollment status for the MSU Satisfactory Academic Progress Policy, Federal Pell Grant, ND State Grant, ND Career and Tech, ND Academic, and other scholarships. Make sure all changes to your enrollment are completed by that time!

Your initial award is based on full-time enrollment. If you plan to enroll in less than 12 credits per semester, please notify the financial aid office by email at financialaid@MinotStateU.edu.

For a complete schedule of dates and deadlines, refer to our MSU calendar.

Yes. The University reserves the right to adjust your award on the basis of additional information that may become available including, but not limited to, verification of your FAFSA information, scholarships, waivers, grants or other third party payments, and changes in enrollment status. Total financial aid received cannot exceed the total Cost of Attendance (COA).

Keep in mind that students who officially withdraw from MSU, never participate in academic activity in a class, or stop attending classes within a semester are subject to having their financial aid reviewed and possibly returned to the U.S. Department of Education.

You are required to maintain Satisfactory Academic Progress toward completion of your degree program in order to continue being eligible for all types of federal financial aid, some scholarships, state grants, and some non-federal alternative loan programs.

The SAP policy requires you to:

- Maintain at least a 2.0 cumulative GPA as an undergraduate or at least a 3.0 GPA as a graduate student

- Successfully complete at least 66.667% of the cumulative credits attempted

- Complete your degree before you attempt more than 150% of the published number of credits needed to complete your degree program

SAP is evaluated at the end of each semester for all enrolled students after all grades are posted. Students who are not meeting SAP standards are notified by email and will also see a SAP Hold in Campus Connection. For more detailed information on SAP standards, visit our website.

- Successfully complete your coursework without financial aid to bring your cumulative GPA and rate of completion to meet the minimum standards

- If the Financial Aid Disqualification was due to an extenuating circumstance, such as a death of a close relative, serious illness, or other situations beyond your control, you may file a SAP Appeal

- The SAP Appeal must include complete documentation of the circumstance(s) and evidence to demonstrate that you are now in a position to be successful in your courses

Processing aid

Verification is the process Minot State uses to confirm the accuracy of data reported on your FAFSA. MSU must verify this information before you are awarded financial aid.

Each year, the U.S. Department of Education randomly selects a percentage of the University's population to complete the verification process.

Typical documents required are copies of your and/or your spouse or parent's federal tax return transcripts from the previous year and a verification worksheet. Minot State may request additional documents to fully verify your FAFSA information.

If you are selected for verification, we will send you a request for required documents by mail or to your Minot State email account. The list of required documents is also available in your To Do List on Campus Connection.

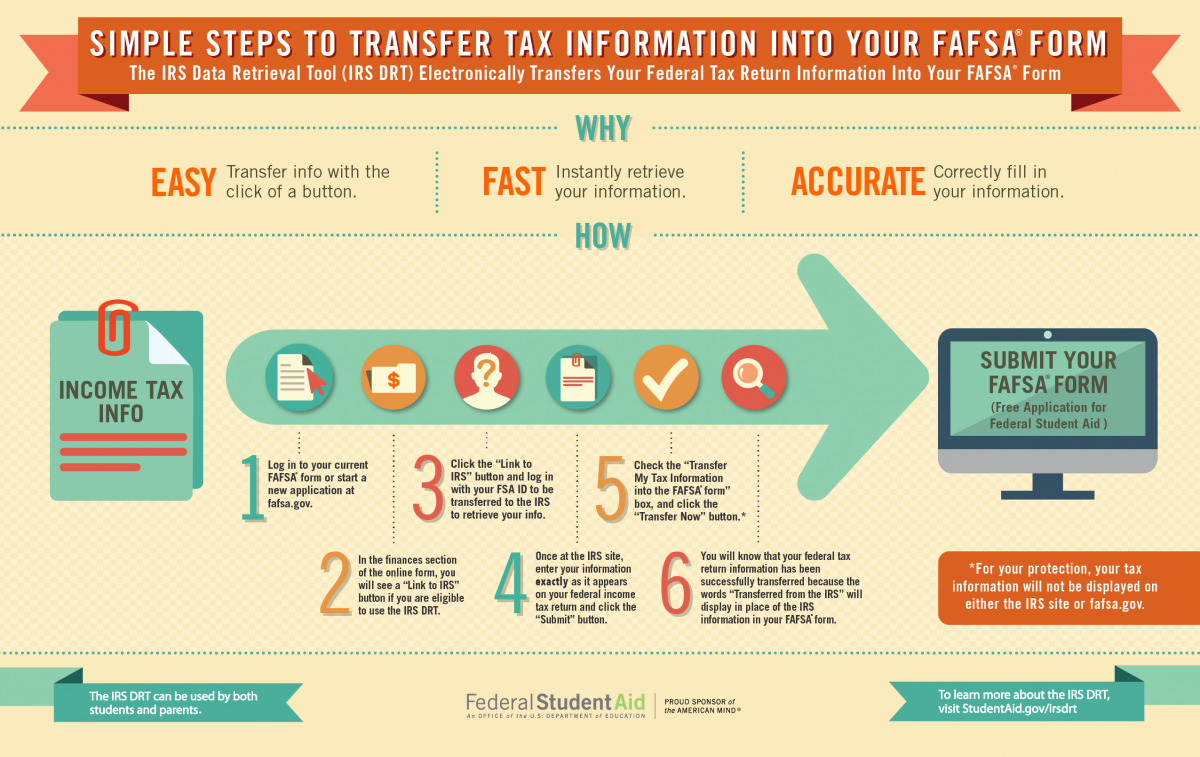

The IRS Data Retrieval Tool (DRT) is a function in your FAFSA where if you and/or your parents filed an IRS tax return, you have the option of directly transferring required tax data from the IRS database into your FAFSA.

We encourage you and your parents to use the IRS DRT to update tax information to the FAFSA for timely and accurate data.

You should not use the DRT if the following conditions apply:

- You filed an amended federal return

- Your federal tax filing status is married, filing separately

- You filed a foreign tax return

IRS Tax Return Transcripts may be requested online, by mail, by phone, or in person. Make sure to request the IRS Tax Return Transcript and NOT the IRS Tax Account Transcript.

Online request:

- Go to IRS.gov and click "Get Transcript Online." This immediately displays a PDF version of the Tax Return Transcript, Record of Account Transcript, Wage & Income Transcript, or Verification of Non-Filing for you to view, print, and/or save. This method requires additional authentication to establish a user account.

Mail request:

- Go to IRS.gov and click "Get Transcript by Mail." Transcripts arrive in five to 10 calendar days at the address the IRS has on file for you.

Phone request:

- Call 800-908-9946

- Follow prompts and enter your social security number and address

- Choose "Option 2" to request an IRS Tax Return Transcript and enter the appropriate tax year

In-person request:

- Make an appointment with your local IRS Office to request a tax transcript

Receiving aid

The University has set up an arrangement with the Barnes & Noble Bookstore on campus to allow eligible students to charge their textbook and supply purchases for a limited time at the start of each semester. In order to charge books at the bookstore, you must have some form of financial aid accepted and be enrolled on the business day prior to charging.

For exact dates on when bookstore charging is available, visit the MSU Calendar.

Financial aid will begin applying to your balance in Campus Connection within a day or two after the last day to receive a 100% refund for dropping and/or adding regular 16-week/full semester courses. This is just before the fee payment deadline each semester.

Financial aid funds (except federal work-study) are first applied to amounts due your eligible University charges. If there is more financial aid than is needed to pay those charges, a refund will be generated to you.

Work-study awards are not applied directly to student bills. Work-study earnings are paid through the bi-weekly student payroll process. You receive those funds directly through scheduled direct deposits after reporting hours worked at your assigned job(s).

If the financial aid you received is greater than the balance you owe Minot State, the excess aid may be direct deposited into your bank account. You can find instructions on enrolling in direct deposit through your Campus Connection. Please allow two to three business days for monies to be deposited into your bank account through direct deposit.

If you have not enrolled in direct deposit, you need to pick up your excess aid check at the business office, located on the second floor of the Administration Building. If you are a distance education student or unable to pick up your check in person, you will need to contact the business office at 701-858-3333 and request your check be mailed.

Financial aid can be used for room and board expenses whether you live on or off campus. You may indicate your living plans when completing the FAFSA. If your housing plans change after you submit the FAFSA, contact the financial aid office.

There are a few options to consider when paying the remaining balance owed to the University, including self-pay, setting up a Tuition Payment Plan with the business office, or your parents applying for a Parent PLUS loan or alternative loans (non-federal loans).

- MSU Tuition Payment Plan

- Applying for a Parent PLUS loan

- Applying for a Private Education Loan

- Choose the FASTChoice button, a comparison tool that you can use to compare loans recently borrowed by other Minot State students

Yes. The following reasons may cause your financial aid to be applied late to your account or not at all:

- If you have not accepted/declined your financial aid award in Campus Connection

- If you did not complete the Master Promissory Note at StudentAid.gov

- If you did not complete Loan Entrance Counseling at StudentAid.gov

- If your FAFSA application is selected for verification and you have not submitted any or all requested documents

- If you have not been fully admitted to Minot State

- To be fully admitted, you must provide all required documents to enrollment services. These documents include final official high school, dual credit, and/or college transcripts.

- If you do not meet the Satisfactory Academic Progress (SAP) standards

Communicate with the business office and explain why your bill is not paid and your financial aid is pending. You can fill out a deferment form, which allows you a little more time to get your financial aid processed.